In our previous article on Pan-European FBA titled Pan-European FBA: How this Amazon service can help your business skyrocket to success, we demonstrated the advantages of using this service, and how Pan-European FBA can help to cut your fulfilment fees, simplify the distribution process and help you to attract more customers.

In this article, we will discuss how you can register for Pan-European FBA, but we will also examine one of the things to be considered before signing up for this service as it can make the process slightly more complicated and – what we will be looking at – change your VAT obligations in European countries.

How can I register for Pan-European FBA?

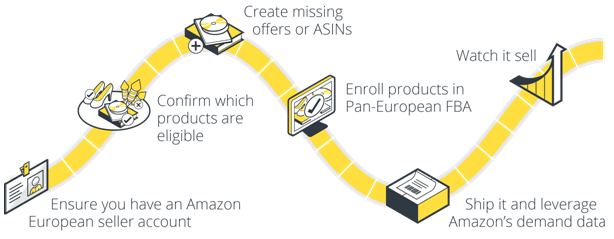

Before you can sign up to use Pan-European FBA, you need to make sure that you have an Amazon European seller account, and also that you are registered with Fulfilment by Amazon. Besides, you have to confirm that your products are eligible for Pan-European FBA and activate your offers in all 5 European marketplaces. The graphic below demonstrates the process of advancing from fulfilment by Amazon to Pan-EU Fulfilment by Amazon.

You can find out more on how to enrol in Pan-European FBA by visiting the Amazon Services website here.

What are the VAT implications I need to be aware of?

Let’s suppose you sell your products to EU country destinations via Fulfilment by Amazon and sales are going well. Before you know it, you are legally obliged to register for VAT in one or more countries and you need to begin complying with their respective local VAT regulations, go by their VAT calendar (submit VAT statements) once you have made a certain amount of sales in that country (i.e. in the perspective of the tax authority: once you have passed the distance selling threshold of that country). With Fulfilment by Amazon, the key idea is to store your inventory in your home country and to have it shipped cross-border to EU countries as and when orders are made – you only need to register for VAT in any of those countries once you have crossed the sales threshold. Once this happens however, the game changes quickly. As a seller you are immediately fully responsible and the tax rules and regulations may be strict in that certain country. You might get fined for backdated VAT or for late submission of a VAT statement. So the best thing is to be aware of what is coming eventually.

However, the rules are a little different when you are trading whilst using the Pan-European FBA program.

By signing up for Pan-European FBA, you authorise Amazon to store your inventory in warehouses across the five European marketplaces – UK, Germany, France, Spain and Italy. Whenever you store inventory anywhere other than your home country, the question of the sales threshold actually disappears. What happens is that you immediately become obligated to register for VAT in that country. This means that in the countries in which Amazon stores your products, you will be responsible for the collection, payment and filing of the respective country’s VAT. You will also need to be aware of and comply with their respective rules and regulations of each country you are registered in. This is extra work for your business and adds complexity to the process, maybe also draws manpower you could use elsewhere which is not ideal at a time when you want to focus on developing your business.

The VAT implications demonstrated need to be taken into careful consideration by anyone who is planning on registering to trade using Pan-EU Fulfilment. If you do decide to sign up to use Pan-EU Fulfilment, J&P can help to take the pressure of being VAT-compliant off your shoulders. We are global tax experts and one of our key areas is to offer services in VAT Registration and helping businesses to complete their VAT returns. We even do Amazon seller reinstatements if needs be.

If you have any doubts or queries with regards to Amazon fulfilment, EU VAT and cross-border sales, please do not hesitate to call us on 0161 637 1080 or send an e-mail to enquiries@jpaccountant.com. Follow our social media channels for regular updates on Amazon fulfilment regulations and changes to VAT laws across Europe.

We will be pleased to help you so you can fully concentrate on your business without having to worry if you are VAT compliant. Just call or email us to get a free quote.